With the planned total removal of subsidy on electricity and petrol by the federal government next year, stakeholders have warned that this could fuel the already tensed economic atmosphere in the country.

Stakeholders are jittery over the development, saying it is bound to impact negatively on their operations, as well as the quality of life of most Nigerians who are already grappling with harsh economic conditions amidst dwindling incomes.

Of particular concern to manufacturers is the high cost of electricity and the impact it will have on production as they are already paying millions of Naira in energy bills on a daily basis.

Many Nigerians are worried this move by the government could heighten the already tensed economic atmosphere in the country even as some experts believe subsidy removal could save the country trillions of naira spent annually on subsidy which could be invested in sustainable infrastructural development. They, however, advised that caution must be taken to ensure the best outcomes for the government and people of Nigeria.

According to them, Nigerians are currently battling with subsidy removal on gas coupled with inflation amidst low disposable incomes, so the removal of electricity and petrol subsidies next year would be too much of a burden for the masses to bear.

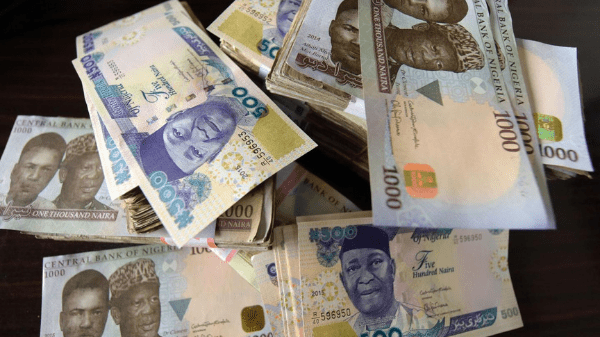

Petrol subsidy has cost Nigeria N864 billion ($2.1 billion) in the first nine months of 2021, up from N107 billion in 2020, to reach the highest deduction in six years, as rising oil prices increase the cost of imports.

Finance minister, Zainab Ahmed, said the government planned to remove the subsidy on PMS (petrol) by the middle of next year and cushion the effect with N5,000 monthly payments to 40 million poorest Nigerians, which translates to about N2.4trillion.

However, the National Assembly (NASS) declared that the proposed N2.4trillion for palliatives was not provided for in the budget even as it queried the modality for distributing the palliatives.

To the former director-general at the West Africa Institute for Financial and Economic Management (WAIFEM) and the chairman of the Foundation for Economic Research and Training, Professor Akpan Ekpo, there ought to be a gradual phasing out of the subsidy as doing it abruptly would have an adverse effect on the economy.

He said the impact of subsidy removal will be felt by both demand and supply, with more emphasis on the demand side.

“For me, once you touch the fuel price, it affects every other commodity; all prices will go up. We call that structural inflation.

“So, I will advise that it should be implemented in phases and the money you would have paid for subsidy, you use that for infrastructure development, education health, roads, but it should be phased.”

On the proposed transport subsidy, he said it is a step in the right direction.

“It is to cushion the adverse impact of the removal. Once you remove subsidy, transport fares will go up as well as other prices. Already, food prices are at a very high level, but how they will go about it is what is unclear. Some countries that removed subsidy years ago gave workers vouchers to buy petrol, but not to rich people. So, I think it is a step in the right direction,” he said.

On his part, head of research, Agusto & Co, Jimi Ogbobine, noted that the economic implication of fuel subsidy “is that we spend over N1 trillion every year on fuel subsidy. Asides this, the oil and gas sector is losing money, particularly the downstream, because it leads to constriction of investment in that sector, and constriction of investment leads to weaker profitability of the sector, which also affects what the government will earn in taxes.

“If we look at all of this, then I think this government should not delay in making this decision because it then becomes more difficult doing it in 2023. If they don’t do it before 2023, it means that this government will be passing it to the next government and that government will have to do it early enough in its own administration. 2022 is like the last window of opportunity that this government has to make that decision because we know that come 2023, they will not be able to do it.”

On the transport subsidy, he said with over N2 trillion planned, it may not be economically viable.

“On the transport subsidy, we need to see what the budget implication of that will come down to. The simple arithmetic of that is that it will cost us over N2 trillion, which then questions the basis behind it because it then becomes even more than the initial fuel subsidy,” he pointed out.

An economist and chief executive of the Centre for Promotion of Private Enterprise (CPPE), Muda Yusuf, said: “I believe that there is a need to creatively manage the transition from the current pricing regime to a fully deregulated arrangement.

“It is a tricky issue which could pose a serious challenge to government, if not tactically managed. The reality is that the sentiments among the citizenry are not favourable to the deregulation of petroleum product pricing or petroleum subsidy removal. Even some of the ruling elite are curiously not persuaded on the justification for the subsidy removal.”

“If the policy transition is not properly managed, the risk of a social and political backlash could be quite high. No doubt there is a sound economic and business case in favour of fuel subsidy removal, but the social and political contexts are equally critical.

“Certainly, the subsidy is not sustainable, which is why there is need to accelerate engagement with the relevant stakeholders to come up with a policy transition strategy that is sustainable, realistic and pragmatic. The conversation should not only be economic, but also social and political,” he averred.

On subsidy payment in the power sector, Yusuf argued that the subsidy argument is slightly different in the case of electricity.

He observed that, already, some progress has been made towards a market-driven electricity framework.

“We already have the willing-buyer, willing-seller policy. There is also a market segmentation model that has been adopted by the electricity distribution companies (DisCos). Different pricing applies to different segments.

“This is also a move towards a purely market driven electricity market. It is true that to sustain private investment in the electricity sector, the subsidy should be discontinued. But the transition needs to be strategically managed because of the political and social contexts.”

To the director-general of Lagos Chamber of Commerce and Industry (LCCI), Dr Chinyere Almona, the removal of subsidy is becoming more and more unavoidable looking at the pressure it puts on public revenue.

She said, “We have always advocated that we need to have a fully deregulated oil and gas sector in Nigeria and have cost reflective pricing for the oil products. Spending a whooping N250 billion monthly on fuel subsidy at a time when our debt to revenue ratio is above 73 per cent is not economically wise.”

She said the immediate implication of removing subsidy will be the increase in transport and logistics, which will transfer to higher costs for goods and services, rising inflation, more people thrown under the poverty line due to diminishing purchasing power, and likely rise in unemployment level.

“However, with more money freed for other purposes, the government should be able to spend more on utilities to cushion the effects of the removal. With a cost reflective pricing, smuggling of the products to neighbouring countries will reduce due to reduced margins.

“Government will make more money to attend to Nigeria’s infrastructural deficits, reduce debts, and attract more foreign investors to the sector, among others. The fact remains that the oil products most used by the masses had been deregulated before now – I mean kerosene and diesel. So why can’t we also leave petrol price deregulated? Moreover, one of the provisions of the Petroleum Industry Act is the removal of fuel subsidy,” she said.

On the proposed N5,000 to be given to poor people, the LCCI DG said: “We wonder how the selection will be made and from what database or register. What is the guarantee that the money will end up with the right people needing the intervention?

“One of the biggest problems with our social investment programmes is that we do not have a systematic methodology on how beneficiaries are selected. Again, we need to do the planning to see if it is more beneficial to give out the money or spend more on public goods. We can spend more on rail infrastructure, spend more on digital infrastructure to support work from home and virtual events, and this reduces pressure on the roads.”

On its part, the Major Oil Marketers Association of Nigeria (MOMAN) is demanding the full deregulation of the downstream sector of the petroleum industry within six months in line with the provisions of the Petroleum Industry Act (PIA).

Chairman of MOMAN, Olumide Adeosun, disclosed that the association had made its position on the issue known to the federal government through a letter to the minister of state for petroleum resources.

He said the group expects a free, fair and competitive downstream sector, stressing that Nigeria has the potential to become Africa’s energy hub if the PIA is properly He stressed the need for the PIA implementation committee to work with industry practitioners and operators to ensure that there is no disconnect between the policy provisions and actual practice.

“Making the transition to a fully competitive pricing-oriented downstream sector will require the collective engagement and resolve of all stakeholders. I assure you that MOMAN will continue to be at the forefront in bridging the government and the private sector gap in ensuring that Nigeria has a viable energy sector,” he stressed.

A study of the allocations for the ministries of finance and petroleum resources in the 2022 budget showed that the Federal Government made no provision for petrol subsidy for the coming year.

However, LEADERSHIP Weekend learnt that the commodity might still be subsidised in 2022 as the country’s sole importer of petrol, the NNPC, stated that there had been no counter order on subsidy from the federal government.

The NNPC insisted that until negotiations with labour unions were concluded, the price of the commodity would remain the same, stressing that the minister of state for petroleum resources, Timipre Sylva, had earlier stated this.

On his part, the national president of the Independent Petroleum Marketers Association on Nigeria, Chinedu Okoronkwo, told our correspondent that the situation may remain as government has not asked them to adjust their pumps.

Meanwhile, the labour groups said the move by the federal government will further impoverish the masses, asking questions on the commitment of the government to subsidy removal.

The president, Association of Senior Civil Servants of Nigeria (ASCSN), Dr Tommy Okon, said: “On electricity, are Nigerians enjoying the electricity today? Should such money (N2.4trn palliative) not be channeled to assist in that sector so that small and medium scale businesses can benefit? They have lost focus on what and how to offer good governance, hence, they are embarking on trial-and-error policy.

“Did they not tell us that the subsidy was removed before? Then which subsidy are they removing now? I believe it is time the EFCC and other anti-graft agencies investigate those corporate bodies who are deceiving the country in the name of subsidy or else we keep hearing of subsidy removal every time.”

Saying the country keeps talking of subsidy rather than bringing back to full capacity the use of the four nation’s refineries, he added that the proposed N2.4 trillion palliative can be used to maintain the refineries or set up additional ones, rather than depending on importation of petroleum products.

The general secretary, Federation of Informal Workers of Nigeria (FIWON), Comrade Gbenga Komolafe, said the removal of subsidy would have an impact on Nigerian workers as the minimum wage of N30,000 would by then be too paltry and meager to do meaningful thing.

On its part, the National Union of Textile Garment and Tailoring Workers of Nigeria (NUTGTWN) stated that the removal will further impoverish the people, saying government and politicians are insensitive to the suffering of the poor citizens.

The president, Nigeria Labour Congress (NLC), Comrade Ayuba Wabba, had posited that the union continues to maintain its rejection of deregulation based on import-driven model, noting that it is difficult to convince Nigerian workers why the country is the only country among the OPEC member countries that cannot produce its own refined petroleum products and thus adopts the neo-liberal import production model of refined petroleum products.

“We wish to reiterate our persuasion that the only benefit of deregulation based on import-driven model is that Nigerian consumers will infinitely continue to pay high prices for refined petroleum products. This situation will definitely be compounded by the astronomical devaluation of the Naira which currently goes for N560 to $1 in the parallel market.

“Thus, any attempt to compare the price of petrol in Nigeria to other countries would be set on a faulty premise as it would be akin to comparing apples to mangoes,” he said.

Stating that the contemplation by government to increase the price of petrol by more than 200 per cent is a perfect recipe for aggravated hyper-inflation and astronomical increase in the price of goods and services, he added that this will open a wide door to unintended social consequences such as degeneration of the current insecurity and possibly citizen revolt.

“This is not an outcome that any sane Nigeria wishes for. The argument that the complete surrender of the price of petrol to market forces would normalise the curve of demand and supply as its being wrongly attributed to the current market realities with cooking gas, diesel and kerosene is very obtuse.

“The truth is that these commodities which Nigeria can easily produce have been priced out of the reach of most Nigerian families with a majority of our people resorting to tree felling and charcoal for their energy needs,” he said.

The International Monetary Fund (IMF) had earlier asked the federal government to completely exit the subsidy regime. The World Bank has equally advised government to end its costly petrol subsidy within the next three-to-six months, improve exchange-rate management and speed up other reforms to boost growth.

Fiscal pressures have increased for Nigeria as higher petrol subsidy costs cut revenues, the bank said in a report, urging bold reforms to boost income.

“The Premium Motor Spirit (PMS) subsidy is eroding Nigeria’s limited fiscal space to provide essential services,” it said. “Aggressive reform effort could contribute more to growth than a sustained period of high oil prices.”

“Nigeria has fallen behind on implementing reforms started at the height of the COVID-19 pandemic,” the bank said, adding that growth rates will lag those of other emerging economies, unless momentum is restored.”

“The subsidies regime in the (petroleum) sector remains unsustainable and economically disingenuous,” Finance minister Ahmed said during the launch of the report.

The World Bank revised Nigeria’s GDP projection to 2.4% this year, from 1.8% earlier, after the economy grew just over 4% in the third quarter, its fourth consecutive quarterly rise, following the COVID-19-induced recession in 2020.

The World Bank said the economy’s prospects have improved, but the recovery is fragile and action is needed to reduce poverty arising from high inflation.