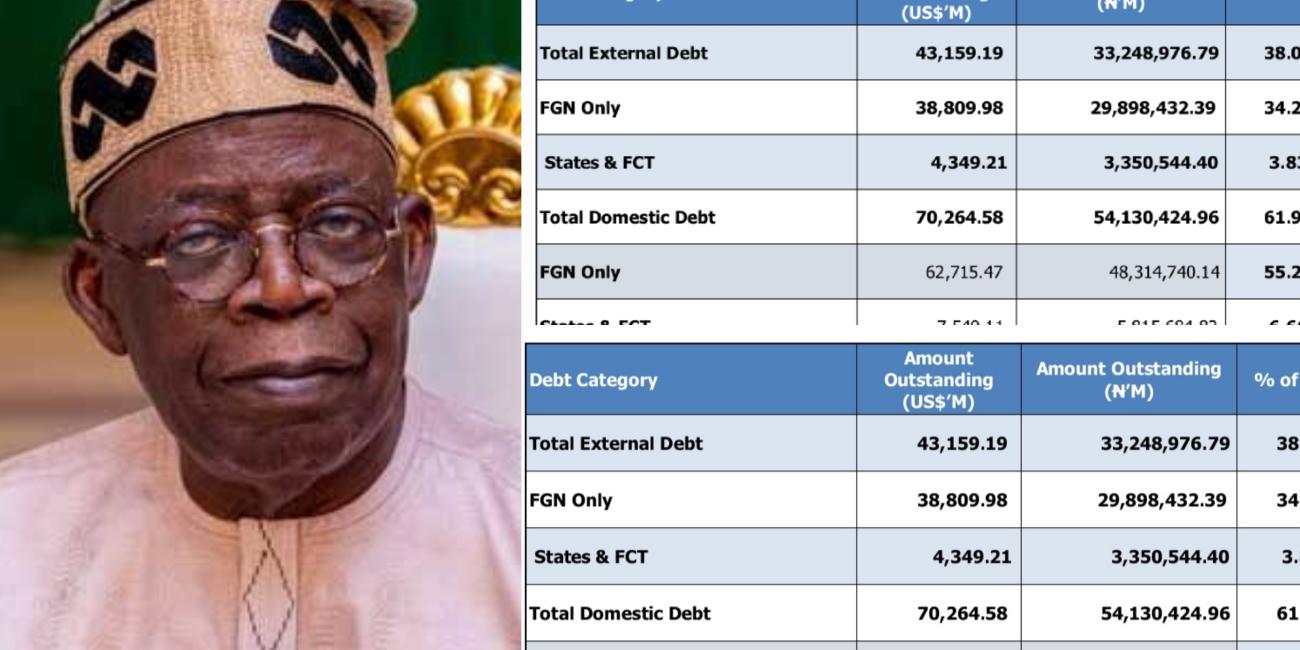

A recent analysis of official data shows that Nigeria’s debt profile has surged by N55.2 trillion within the first 19 months of President Bola Tinubu’s administration, despite earlier pledges to reduce the country’s dependence on loans.

A review conducted by Reporters based on figures from the Debt Management Office (DMO) reveals that between June 2023—Tinubu’s first full month in office—and December 2024, the Federal Government’s debt portfolio expanded significantly.

As of June 30, 2023, Nigeria’s external debt stood at N29.8 trillion. By December 31, 2024, it had grown to N62.9 trillion—an increase of N33.1 trillion. Domestic debt also rose sharply during the same period, from N48.3 trillion to N70.4 trillion, marking a N22.1 trillion increase.

Combined, this puts the total rise in the Federal Government’s debt at N55.2 trillion, excluding debts owed by state governments and the Federal Capital Territory.

This increase comes in contrast to President Tinubu’s statement during the inauguration of the Presidential Committee on Tax Reforms in August 2023, where he expressed a commitment to end Nigeria’s overreliance on borrowing. He had stated that the cycle of debt would be broken under his “Renewed Hope” agenda.

However, economic reports suggest otherwise. In Q4 2024 alone, the government spent N2.199 trillion on debt servicing—surpassing both the budgeted N2.067 trillion and the N2.055 trillion spent in the previous quarter.

According to the Central Bank of Nigeria’s economic report, Nigeria’s public debt stock stood at ₦142.32 trillion as of September 2024—representing 51.29% of the country’s GDP. While still below the 70% benchmark for market-access countries, analysts warn that continued borrowing could worsen the nation’s fiscal outlook.

The rise in debt has been attributed to exchange rate depreciation and new borrowing to fund the 2024 national budget.