Abuja, May 8, 2025 — Nigeria has fully repaid the \$3.4 billion emergency loan it received from the International Monetary Fund (IMF) during the COVID-19 pandemic, but the country remains liable for nearly $30 million in annual interest and charges, the IMF has confirmed.

The repayment, finalized in April 2025, was part of the Rapid Financing Instrument (RFI) designed to support countries facing economic shocks due to the pandemic and global oil price collapse.

In an email statement sent to Reporters, the IMF Resident Representative for Nigeria, Mr. Christian Ebeke, confirmed the repayment:

“As of April 30, 2025, Nigeria has fully repaid the financial support of about \$3.4 billion received in April 2020… to help alleviate the impact of the COVID-19 pandemic and the sharp fall in oil prices.”

Despite clearing the principal loan, Nigeria will continue to pay Special Drawing Rights (SDR) charges** estimated at SDR 22.35 million for 2025—roughly \$30.17 million, based on an exchange rate of SDR1 = \$1.35.

According to the IMF, these charges arise from the difference between Nigeria’s current SDR holdings and its total SDR allocation, in line with IMF policy.

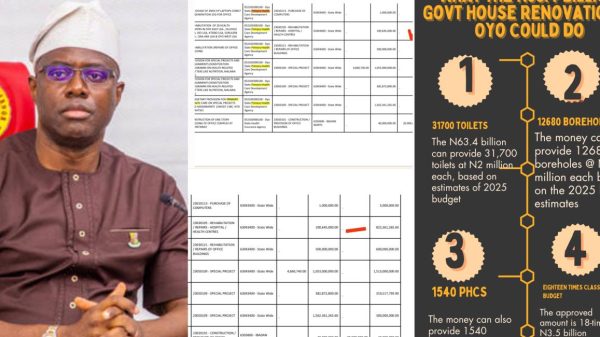

Between 2026 and 2029, the country is expected to pay SDR 25.9 million annually, translating to about $34.9 million each year. In total, Nigeria’s charges between 2025 and 2029 will amount to SDR 125.99 million**, or approximately $166 million.

Debt Service Burden and Currency Losses

Though the federal government has celebrated the loan’s repayment, the Central Bank of Nigeria (CBN) reports show the overall IMF-related liability ballooned due to the Naira’s depreciation. The debt, recorded at N2.5 trillion in 2023, surged to nearly N5 trillion by the end of 2024.

A SaharaReporters analysis of January 2025 economic data revealed that Nigeria spent N696 billion on debt servicing that month alone, exceeding the monthly allocation of **N689 billion. Notably, zero naira was allocated for capital projects during the same period.

While presidential spokespersons have disputed these figures, the data aligns with official IMF records and the CBN’s financial reports.